DUCA solved the 'Stablecoin Trilemma'

What is it, and how did DUCA solve it?

Solving the stablecoin trilemma by making a fully functional scalable and decentralised stablecoin is a holy grail of the crypto industry. Vitalik Buterin described such a globally accessible stablecoin, which could also withstand extreme on-chain and macroeconomic conditions, including potential fiat hyperinflation, as a revolutionary step for the industry.

As cryptocurrencies propagated the ideas of decentralised peer-to-peer digital cash, it quickly became clear that the industry needed less volatile and more 'stable' means of exchange to draw capital and increase mainstream adoption; the stability expressed in the exchange value against fiat money. A subsequent introduction of stablecoins created an incredible boom and quick development across decentralised finance, but resulted in high-profile hacks and attacks that brought forward the urge to solve the stablecoin trilemma.

What is the stablecoin trilemma?

Crypto researchers and developers stipulated that any given stablecoin can only ever reach two out of three necessary conditions for a “perfect stablecoin” and it needs to compromise between price stability, capital efficiency, and decentralisation.

- Stability is a stablecoin’s ability to maintain a stable value, expressed as its exchange rate against a chosen reference asset, most often a fiat currency. Stability also touches upon the stablecoin’s ability to withstand economic and speculative attacks while maintaining a stable value.

- Capital efficiency expresses the cost of creating stablecoins through the collateral required, optimally 1:1. Low capital efficiency restricts the coin’s global scalability and the protocol’s sustainability making coins not cost-effective to produce. High capital efficiency can lead to under-collateralization and the lack of liquidity necessary to exit the market.

- Decentralisation makes any alternative decentralised currency independent of centralised entities and governments. It guarantees that a stablecoin cannot be restricted, frozen, seized, or stolen by third parties, and only then can it enable truly decentralised finance.

In this article, we will explain how the DUCA Stable Value Protocol solves the stablecoin trilemma. If you would prefer to listen, you can tune into our Podcast detailing how DUCA solves the stablecoin trilemma.

What is duca?

DUCA is the first viable form of programmatic money made possible by a triple token economy that solves the stablecoin trilemma and aims to become a global alternative to traditional currencies.

DUCA is a Stable Value Asset with an exchange rate stabilised against a mathematically designed dynamic reference value. This algorithmic exchange value identifies quality currencies and translates this into a growth percentage. This percentage is expressed through the SDR and results in a reference value that maintains purchasing power.

DUCA’s stable value is maintained by a fully automated on-chain Stable Value Protocol, which is a fundamental design solution enabling the creation of versatile stable assets with different reference values.

How Does the DUCA Protocol Solve the Stablecoin Trilemma?

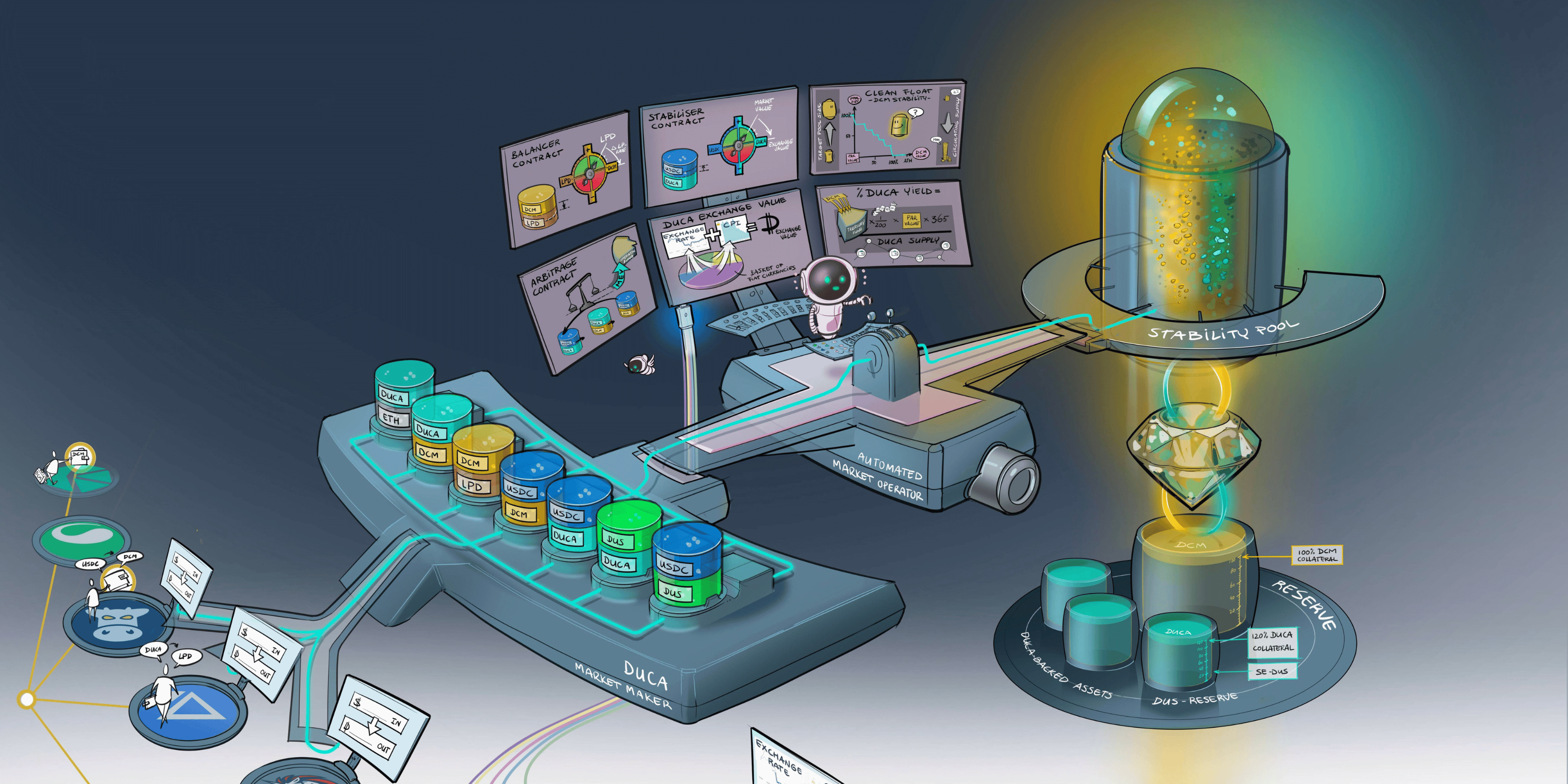

DUCA solves the stablecoin trilemma through a novel triple token economy that consists of a stable store of value asset (DUCA) and two supporting utility tokens (DCM and its liquidity pool equivalent LPD).

While the positive sum asset DUCA brings stability, yield, and maintaining purchasing power, the protocol’s negative sum tokens DCM and LPD are balancing each other in a purposefully volatile system enabling value speculation and significant yield opportunities for the high-risk high-reward market participants.

The system’s volatility is offset by the secondary tokens, which are then subject to multiple system requirements and careful incentives managed by a fully on-chain Automated Market Operator (AMO). The cost of the system relies on DCM and LPD holders in exchange for significant market opportunities.

How Does the DUCA Protocol Maximise Capital Efficiency?

The DUCA Stable Value Protocol provides capital efficiency and enables enormous >20T scalability compatible with traditional fiat currencies through a novel approach to endogenous collateralization.

Stablecoins predominantly use exogenous collateral in the form of real-world assets and fiat, or volatile cryptocurrencies. That type of collateralization is limited and doesn’t enable the scalability necessary to match traditional currencies on a global scale. Additionally, the fiat collateral impairs decentralisation through the use of centralised assets. On the other hand, the endogenous collateral created using intrinsic protocol tokens has been, until now, deemed insufficient to enable market exit in extreme conditions when its value drops significantly.

The DUCA protocol goes back to the core of what it means to collateralize by offering complete liquidity and allowing the full market cap of the stablecoin to exit the market, if necessary, without affecting the system’s stability or DUCA’s exchange rate against its reference asset. Once the protocol is launched, the system maintains itself through automated supply and demand management, contracting or expanding native tokens and endogenous collateralization as needed, enabling both global scalability and a complete market exit.

Triple-layer Over-collateralization

The 300% endogenous over-collateralization across the Reserve, the Stability Pool, and DMM liquidity pools offers a deep 3:1 liquidity, which also enables a full DUCA market cap absorption in case of a bank run. The DUCA protocol participants have an unlimited ability to exit the protocol at any time, and exiting the protocol does not jeopardise DUCA’s stability or the system’s resilience crucial during extreme economic conditions, speculative attacks, or bank runs.

1. Reserve

DUCA is fully capital efficient because DUCA is minted against its stability token DCM at a 1:1 ratio. Unlike in dual token protocols, the DCM is never burned but rather sequestered from the circulating supply at the market value and locked into a collateral reserve that represents a complete DUCA market cap. The DUCA reserve constitutes the first layer of endogenous collateralization, able to absorb 100% of DUCA’s total supply.

2. Stability Pool

DCM tokens may be deposited by liquidity providers into a special single-currency liquidity pool, called the Stability Pool, to obtain liquidity pool tokens LPD. The liquidity pool tokens offer various advantages and yield to their owners depending on the status of the protocol. The Stability Pool is designed to absorb excess DUCA to stabilise the market supply and demand forces. It is also able to absorb the total supply of DUCA if necessary, making it the second layer of endogenous collateralization at 100%. DUCA deposited in the pool is burned or reused across the protocol by the Automatic Market Operator (AMO) that balances the system.

3. DMM

DUCA is backed by core liquidity pools inside a Decentralised Market Maker (DMM) working in tandem and operated uniquely by the protocol’s autonomous market operator (AMO) to balance all the native token supplies. The pools are initially able to absorb DUCA’s total market cap and create a third 100% layer of collateralization. This will gradually lower as the market cap of DUCA grows over time, with the speed at which this occurs depending on the market dynamics.

How Does the DUCA Protocol Ensure Stability?

To create programmatic money that can scale to trillions of dollars and become the foundation of decentralised finance, we need to stabilise the Protocol using endogenous collateral. Using anything else is simply not capital-efficient or scalable enough.

The real challenge to solving the Stablecoin Trilemma then becomes how to actualize and stabilise the value of the endogenous collateral, DCM, which in itself doesn’t have an intrinsic value. The protocol requires 3 tokens and a multilayered incentive structure to achieve this. DUCA’s supply is maintained through a simple mint-and-burn mechanism, while the system’s volatility is transferred onto DCM and its liquidity pool token LPD, which are in a symbiotic relationship. The DCM then comes with a series of stabilising mechanisms to ensure sufficient collateralization and maintain its value within safe brackets. The Stability Fee is charged to all the DCM holders to ensure over-collateralization as the first and basic layer of defence by influencing the DMM supply and demand of DCM. Additionally, the Clean Float threshold values referenced to a minimum Par Value are pre-programmed into the protocol and executed by the Automatic Market Maker (AMO) to guard the bottom value of DCM.

Decentralised Market Maker (DMM)

DMM is the point of contact between the DUCA economy and the open market, increasing the protocol’s stability and resilience to speculation. DUCA and the utility tokens are available to the public solely through the protocol’s DMM and its liquidity pools and only the protocol’s AMO can mint and burn DUCA, based on the market price across DUCA pools representative of the open market valuation. The AMO uses arbitrage, balancer, and stabiliser contracts to manage the available supply of DUCA, DCM, and LPD in order to maintain balanced liquidity and collateralization levels. It also takes advantage of the favourable swaps within the DMM. The gains are redirected to the Treasury Fund to sustain DUCA Yield and redistribute wealth to the community.

STABILITY FEE

The DUCA protocol Stability Fee is a crucial innovation in the incentive design that makes the whole system sustainable and enables triple tokenomics to work. Unlike fees across other protocols, it is applied holistically to all the stability token DCM holders. Everyone holding DCM participates and supports the DUCA economy.

The fee is applied through a unique application of a Rebase Mechanism, which charges users a percentage over the amount of DCM in their wallets (or rewards DCM owners by increasing DCM in their wallets), without affecting the total supply of DCM in circulation. A positive fee means the DCM holders pay a %, whilst a negative fee means that DCM holders receive a % of the DCM. The Stability Fee is diverted to the LPD yield and 50% is taken as seigniorage and added to the Treasury Fund and sustains the DUCA Yield.

The total supply of DCM is fixed and never burned. Depending on the situation, the protocol’s Automated Market Operator changes incentives to hold either DCM or LPD, adjusting the DCM circulating supply and redistributing DCM between the users and the Stability Pool.

If the DCM market value goes down, it could pose a risk to the system’s endogenous collateralization. The system decreases the circulating supply of DCM to match the lower demand by increasing the Stability Fee and diverting it to the LPD yield, which makes DCM less interesting and the LPD tokens more attractive to hold. As the DCM holders exit into LPD or other assets via the protocol’s DMM pools, the decreasing circulating supply of DCM balances its lower market demand ensuring that the appropriate amounts of DCM are present in the Stability Pool to maintain appropriate collateralization.

If the DCM value goes up, it’s not a risk to collateralization. The system is designed to guarantee a strengthening of DCM over time with the increasing Par Value and Clean Float described below.

PAR VALUE

Par Value is an exchange rate between DUCA and its stability token DCM, which indicates the value of DCM that marks 100% collateralization.

The protocol is designed with two parameters:

• To keep the Par Value at a minimum of 1:1 ensuring collateralization.

• To never go below the latest established Par Value since the Par Value increases over

time.

A minimum Par Value of 1:1 ensures sufficient collateralization of DUCA in the Reserve, with the Par Value expressed as the DUCA’s market cap divided by the value of DCM stored in the Reserve. Whenever the DCM market value increases, the collateral increases and there is no issue. However, if the DCM market value decreases, it leads to under-collateralization that jeopardises the system. The Par Value requirement indicates the target minimum market value of DCM to ensure the collateralization of the Reserve at 100%.

When the DCM market value drops 1% or more below Par Value the AMO of the protocol activates the DCM stabiliser. It leads to a decrease in the supply of DCM in the DMM whilst simultaneously increasing the market value of DCM.

The Par Value is not a fixed value. It is designed to increase over time as the market cap of DUCA increases. Since DUCA is minted using the market value of DCM and cannot be minted below the latest established Par Value, the increasing demand for DUCA increases the Par Value. The Par Value serves as an important reference value for DCM. Together with the Clean Float, it maintains DCM’s strength and resilience.

Clean Float

Currency exchange rates can be fixed against another asset or floating depending on the market forces. If the rates are influenced by the government or central bank, it is called a dirty float. Dirty float introduces an element of sanctioned market manipulation and non-transparent thresholds on the exchange rates and the strength of the currency.

DCM is a Clean Float token with a market value governed by free market forces of supply and demand, which are managed by the Autonomous Market Operator according to a set of transparent parameters. The protocol has clear rules for DCM’s exchange rate to enable stability and sustainable growth alongside the DUCA’s market cap.

Clean Float manages the capital flow from DCM in the ecosystem based on the relationship of its market value in relation to the Par Value and its ATH (All Time High). This relationship is expressed in the Fibonacci retracement levels. The Par Value represents 0 whereas the ATH represents 138,2%. From here we can derive the 100% level and consequently the levels in between. This dynamic reference model informs the protocol on the target Stability Pool size based on the DCM Market Value. The AMO will adjust the Stability Fee accordingly to increase or decrease the incentives for the LPD owners.

Clean Float ensures that demand for DCM will increase when the market value drops whilst at the same time the level of over-collateralization increases significantly to offset the loss of collateral value by the lowering of DCM market value.

How Does the DUCA Protocol Ensure Decentralisation?

DUCA ensures decentralisation by making the Stable Value Protocol autonomous and putting the majority of processes and structural elements on the Ethereum blockchain. It limits third-party dependencies and makes DUCA censorship-resistant.

The DUCA’s protocol is fully automated and does not require manual operations. It can run independently for eternity. However, the protocol may need small adjustments and quality control in case of unforeseen exploits or market conditions. This is why the protocol has a Maintainer, DUCATA, with access to the codebase for quality control, which requires multisig to deploy. In the next step of DUCA’s decentralisation, the execution of any maintenance by the Maintainer will come under the purview of decentralised governance, with a unanimous vote necessary to deploy changes.

Introducing a Maintainer of the protocol is DUCATA’s solution to the current dysfunctional DAO and governance structures that fail to deliver quality to their users. It enables the best of both worlds, combining quality control with a high level of decentralisation. The Maintainer brings knowledge and credibility to the process to safeguard the original design, integrity, and quality of the protocol, while the community retains the final authority on deployments.

Summary

Solving the Stablecoin Trilemma brings DeFi into a new era by significantly increasing scalability and adoption of stable value crypto native assets while maintaining the robustness of decentralisation.

We believe DUCA solves the stablecoin trilemma and enables the first truly scalable decentralised stable-value currency that’s 100% on-chain and accessible to all. DUCA is censorship-resistant programmatic money managed by an Automated Market Operator with scalability and stability equal or superior to that of global reserve currencies.

The added benefits are that the DUCA economy has been designed with a more equitable distribution of wealth in mind, offering inflation-hedge and passive income opportunities to anyone regardless of their financial literacy.

Join our community to get updates on DUCA’s progress and upcoming release dates.